Remote Team to Develop Custom Buy Now Pay Later Solutions

- Intro to BNPL (Buy Now Pay Later) Software Development

- BNLP App Development Stats

- How Buy Now Pay Later App Development Works in a Nutshell

- Building Buy Today Pay Later Application: Structure and Key Components

- What Are the Most Popular BNPL Apps?

- What IT Experts Are Needed for Building Your Own Buy Now Pay Later App?

- Build a Dream Team for Pay Now Buy Later App Development with Mobilunity

Intro to BNPL (Buy Now Pay Later) Software Development

Although the journey of buy now pay later apps started a few years ago only, such solutions have already established themselves as a popular choice among customers and continue growing in demand. In this article, we discuss why BNPL solutions are beneficial for consumers, retailers, and developers and how to build your own BNPL app to meet the market demand.

The idea of paying for the purchase later is not fresh or innovative, as consumers are well accustomed to using their credit cards to get extra cash for the things they need or desperately want. Alas, this is usually followed by high interest and fees for the overdue card debt, which makes people more cautious using their credit cards.

To encourage customers to purchase more and with ease, a number of businesses and marketplaces, including Target, Wayfair, and Urban Outfitters incorporated BNPL services as an attractive tool that can solve the lack of cash problem. Put simply, one now can use a simple app where you can buy things now and pay later without the need for waiting for loan approval and other bureaucracy. The more payment options an online business can provide, the higher chances are that the consumer will make a compulsive purchase and return. And this is where buy now pay later app development company may come in place.

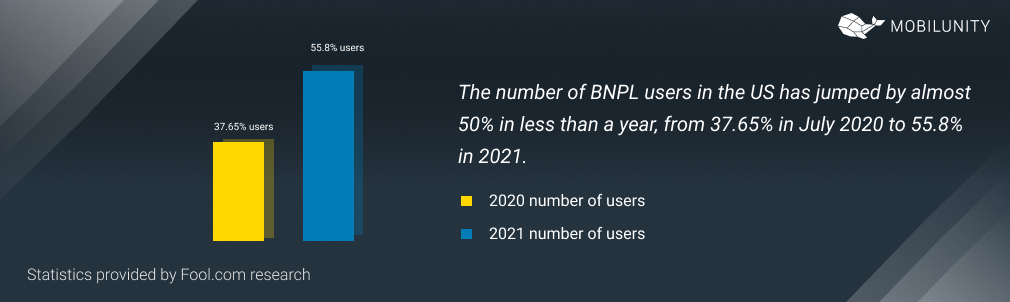

BNLP App Development Stats

As per the Fool.com research, the number of BNPL users in the US has jumped by almost 50% in less than a year, from 37.65% in July 2020 to 55.8% in 2021. No wonder that BNLP services are forecasted to replace or become an equal rival to credit card systems, as they provide a beneficial alternative to delayed payment options. Unlike credit cards that rely mainly on high-interest charges and continuous rollovers, with a buy now pay later app, customers can make a purchase paying part of the initial price only or not paying at the moment of the purchase at all, then pay off the remaining sum over the course of several weeks or months.

After a Covid-driven economic drop in 2020, BNLP services grew in popularity among customers tremendously.

According to Statista.com, in 2021, each third customer of online stores used a buy online pay later option more frequently compared to 2020. What’s more, a BNLP option is considered more transparent and easy-to-control for customers. It’s also more flexible since consumers can select the duration of the repayment. So, how exactly can a customer use such services?

How Buy Now Pay Later App Development Works in a Nutshell

BNLP app allows users to make purchases in a transparent, paperless way, avoiding the turmoil of dealing with credit card debts and the high interests involved. BNPL usually requires simple account registration but can be done even without registering upon purchase and creating an account for repayment only, and the process is quick and easy. After the purchase is made, the BNPL service automatically writes down the installments over the agreed time.

Since app buy now pay later services are user-friendly and offer desired goods and services in one click, they are trendy both amongst youngsters and less tech-savvy adults. Once a customer signs up and verifies their account, they can buy the products right away. During the checkout, the customer needs to select the preferred repayment option. Then, the retailer will receive the total amount for the product from the BNPL service, and the customer will pay down the remaining money over the agreed period to the app.

For customers, buy now and pay later apps are useful options that allow one to make the needed purchase, even when the wallet is thin, avoiding credit interest. For online stores, by offering customers delayed payment options, they can lure more customers, secure the customer retention rate and ensure the continuous money flow despite the economic retention – after all, people will always have things to buy.

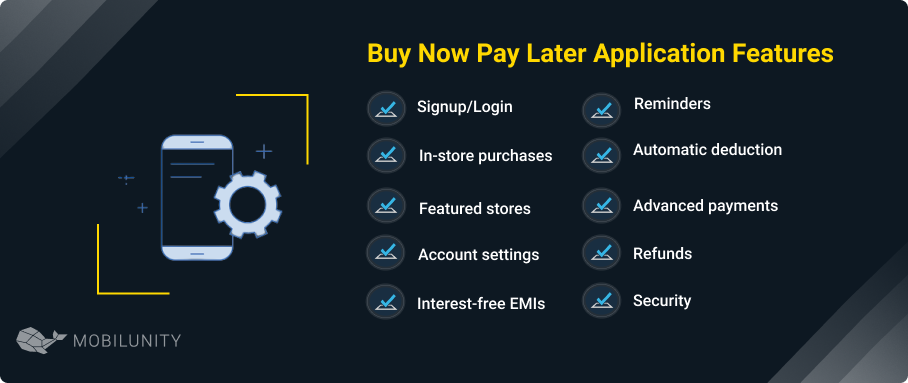

Building Buy Today Pay Later Application: Structure and Key Components

BNPL app development is not that different from building any other software. However, like any high-end solution, it requires expert-level UX/UI designers, developers, QA engineers, and other IT professionals.

Underneath a user-friendly design and distinctive features, a BNPL app has a specific structure and a set of key components as a basis. Here are the essential features that any BNPL application should contain:

- Signup/Login. Provide an easy authentification and verification flow. Allow for a fast purchase with easy onboarding.

- In-store purchases. Offer customers a way to buy a product without signing up upon purchase, as the user can register later for repayments.

- Featured stores. With this section, customers can get familiar with businesses that already offer BNPL options in their stores. Showcase the brands you’re partnering with, so customers won’t need to guess where they can benefit from the BNPL service, seeing valuable information right away.

- Account settings. Make it easy for customers to find all information regarding their payments, orders and manage personal information.

- Interest-free EMIs. Most of the BNPL apps already offer interest-free loans to their customers who make payments on time. Don’t fall behind and provide the most feasible offers to gain the trust of your customers.

- Reminders. Win the heart of your customers by showing extra care. Remind them of the due dates of buy now pay installments so that customers can avoid late fees.

- Automatic deduction. Make the user experience easier by automating most of the operations for customers. Provide the automatic deduction feature that customers can manually enable in their settings for their utmost convenience.

- Payment rescheduling & Advanced payments. Give a customer more room for controlling their finances. Allow to shift the due date or pay in advance and show that you have a personalized approach to every user.

- Refunds. Always make sure that a customer has a chance to reconsider their purchase and change the decision.

- Security. Like all finance-related apps, a BNPL application must have enhanced protection against cyber attacks and data leaks. Ensure the customers are provided with advanced PI protection.

What Are the Most Popular BNPL Apps?

With the increasing interest in BNPL, the number of buy now pay later services grows every year. Let’s look at the most popular BNPL solutions out there:

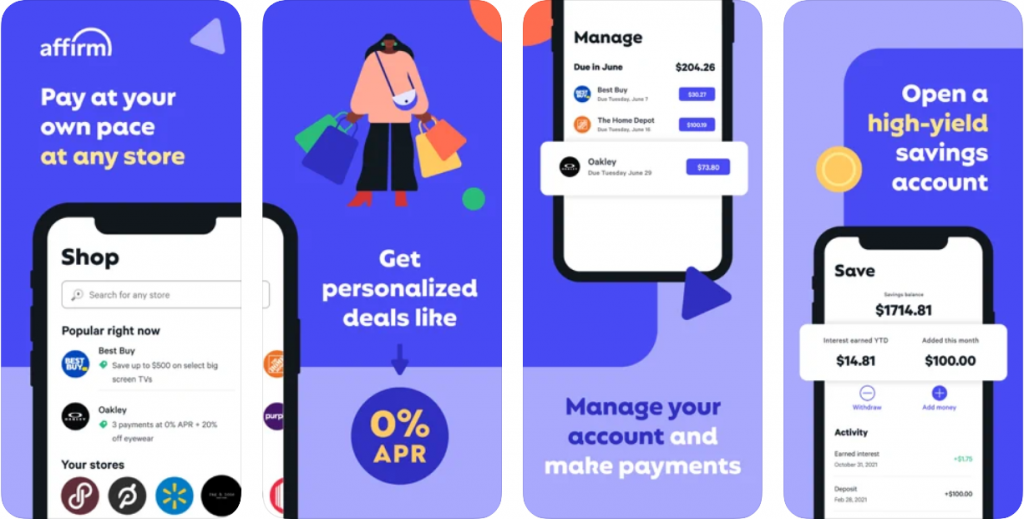

Affirm

Affirm is an open-type company based in California. Affirm offers one of the most popular buy now pay later apps with no fees for most purchases for a customer (even a late fee) and individually provides loans up to $17.500. On the flip side, it requires a soft credit check. Many retailers use Affirm or Affirm clone as a checkout option, especially if their products are on the higher price side.

If you want a build to simple-to-use app for online stores, building a new app like Affirm with custom functions including control over credit score and quick financing solutions can be a great choice. To build an app like Affirm, you will need to hire a dedicated app developer with prior experience in finance software development.

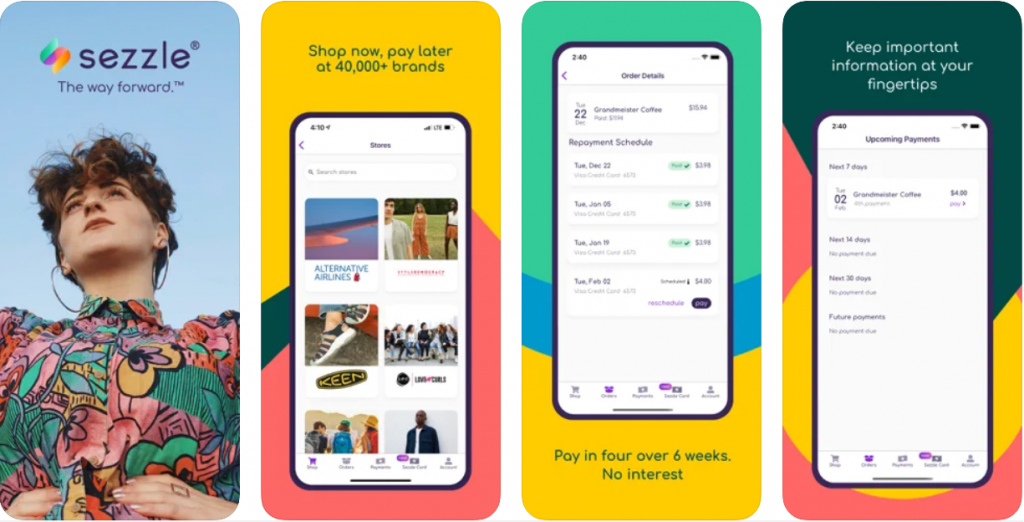

Sezzle

Sezzle, which operates in the US and Canada, offers one of the most flexible payment systems. With Sezzle, a customer needs to pay 25% of the price immediately and pay down other installations every two weeks; however, there is an option to reschedule the payment for a small fee for the next two weeks.

If you build a Sezzle clone with similar offers, you can reach a large target audience that needs more flexible payment options. A new app like Sezzle will likely be attractive for customers, as they will have an opportunity to push their payments for later with no interest on buy besides reschedule fees. To build an app like Sezzle, you will need to hire a dedicated team to design and code the app with similar functions.

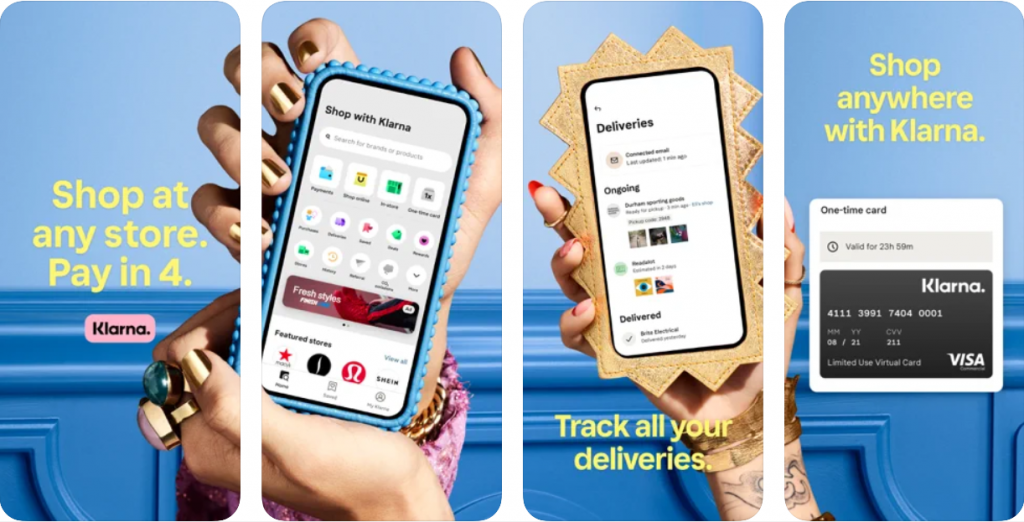

Klarna

It may be beneficial to build an app like Klarna, a service that can be used whenever a credit card is accepted. Klarna provides a one-time virtual card number, which customers can use in online and offline shops. Any purchase is split into four equal payments.

A Klarna clone app will be a feasible choice for any customer who wants to switch from credit card loans to BNPL, as it offers no interest or fee for on-time payments. In a new app like Klarna, you can offer some enhancements, such as easy purchase approval or a softer credit check to have the upper hand.

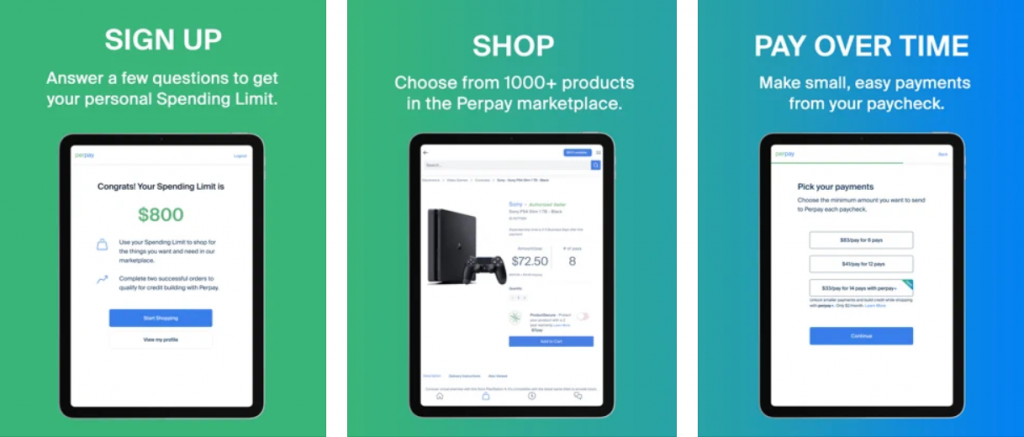

PerPay

If you don’t intend to be strict with the customer’s credit history, you can easily build an app like Perpay. PerPay is a viable option for those with bad credit history, as it checks only the verified income to set the loan limit. As spending money is limited to Perpay’s marketplace (around 1000 brand names on the platform), you may create a new app like Perpay with similar functions and partner with the preferred brands. Besides, with the Perpay clone app, you can adhere to the same rules, such as split payments up to 6 months, ensuring that the customer has a positive payment history with the direct deposit from your payroll.

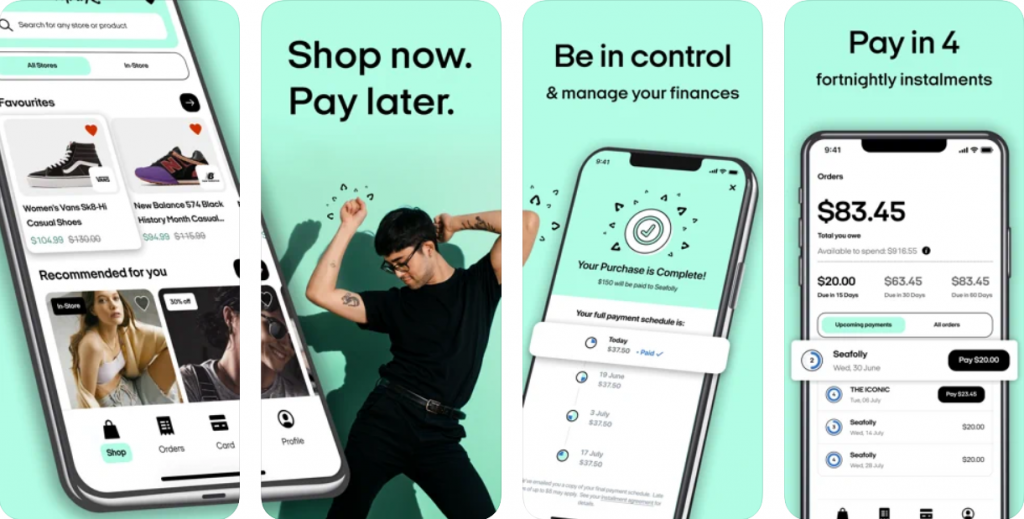

Afterpay

If your main target audience is students, making a new app like Afterpay will be a smart move. Afterpay allows splitting small charges into 4 portions without interest.

To build an app like Afterpay, you’ll need to hire an experienced team of developers. An Afterpay clone can adhere to the same offers as AfterPay, including considerable late fees (up to 25% of the price) or adding more beneficial deals to attract users.

What IT Experts Are Needed for Building Your Own Buy Now Pay Later App?

With a great chance that the buy now pay later solutions will reach the same popularity if not replace the credit card system, it can be a smart investment in creating a BNPL app. To gather a perfect development team that can build a top-quality BNPL application, you will need the following specialists:

Like any other app development, it’s better to start building an app on the iOS platform. To host your app in App Store, you need to hire remote iOS developers to create a fully developed, bug-free, and user-friendly solution that will run like clockwork. An IOS developer will be fully responsible for ensuring you have a viable app that can be approved and listed in the App Store.

Looking for dedicated IOS developer to boost your business? Rely on Mobilunity! >>>

- Android developer

If most of your potential customers are Android users, build an Android app first. For this purpose, you need hire Android developers that can create a paylater app from scratch and submit it to the Google Play Store.

In search of talented Android devs to empower your company performance? Count on Mobilunity! >>>

- Backend developer

When you intend to build custom PC buy now pay later platform, you need to make sure it runs properly. A backend programmer will ensure that your app runs smoothly with no bugs and delays and the payments are processed correctly and securely. The best option to find an app programmer for rent is to reach out to outstaffing services providers.

Hire with Mobilunity and get professional Backend engineer’s assistance with no waste of time! >>>

Without a proper, clear, and well-recognizable interface design, your app is bound to be buried beneath a pile of similar apps. Hire an experienced UX/UI designer that will make an easy-to-navigate application with a memorable and distinct brand look.

Looking dedicated UI/UX designers? Mobilunity is ready to help! >>>

QA engineers monitor the quality of the product at every development stage so that there are no errors and bugs, thereby increasing the quality of the product. Hire QA specialists and gather a trusted customer base by providing a top-quality bug-free app.

Get help of professional vendor and hire dedicated QA engineer effortlessly! >>>

In some cases, you will need a quality check from the DevOps expert. Such a specialist can synchronize all stages of creating a software product, including writing code, testing, and releasing the app. DevOps automates the system, as well as establishes productive feedback between administrative and development departments.

Mobilunity offers different hiring options of DevOps, depending on your needs. Contact us! >>>

When the ultimate plan is to create a cross-platform app, there is a high chance that the team will grow over time and will require more specialists. For some cases, you will need a full-time in-house specialist; for other issues of application outsourcing a part-time worker will be enough. Overall, for app development, the team of dev specialists may consist of:

- Mobile developers

For a big project, one developer is never enough. When it comes to app development, you can’t delay updates and improvements, as you’ll fall behind competitors and lose the trust of your customers. So, it’s more profitable to keep the pace and grow the mobile development team with the growth of your offering.

In search of talented Mobile devs of Middle+ level? Get mobile solutions with Mobilunity! >>>

Financial operations require enhanced security measures. Make sure that you have a cybersecurity specialist in your team to deal with any possible threats to private information and transaction details.

Entrust your cybersecurity to real professionals. Rely on Mobilunity! >>>

- Big Data analyst

A Big Data analyst can analyze the data using BI tools and make suggestions to optimize business processes related to the BNPL service. If you want a clear vision of making the app more helpful to users and more profitable, a Big Data analyst can help you make the right business decisions.

Interested in hiring Big Data analyst? Contact Mobilunity! >>>

Build a Dream Team for Pay Now Buy Later App Development with Mobilunity

More and more companies are turning their heads to overseas talent pools when it comes to software and app development. By option for offshore mobile app development, a business gets access to a wider choice of specialists and can gather a team of the best IT talents quicker, especially with help from a reliable outstaffing services provider.

Mobilunity is a Ukraine-based outstaffing company that helps companies to build dedicated development teams for any project. With a number of successful projects and more than 44+ satisfied clients in various countries, including Sweden, Denmark, Canada, and more, we at Mobilunity strive to provide the best quality service with a personalized approach.

Mobilunity, as a trusted company offering buy now pay later development services, has a successful record of the BNPL app development project, assisting in building a team of the backend, frontend, and mobile developers for a Japan-based fintech app with over 1.5 million current active users. Thus, there is no doubt Mobilunity can turn your business idea into financial success by providing you with the best tech talents in the field.

When hiring a dedicated team for a financial app, it’s vital to make sure that the services provider you work with has already tapped the water in this field, so they can easily source the needed specialists with the required skillsets and relevant skills experience.

Looking for custom Buy Now Pay Later app development? Find an experienced dedicated team with Mobilunity!

Disclaimer: All salaries and prices mentioned within the article are approximate numbers based on the research done by our in-house Marketing Research Team. Please use these numbers as a reference for comparison only. Feel free to use the contact form to inquire on the specific cost of the talent according to your vacancy requirements and chosen model of engagement.