A Deep Dive Into The Use Cases Of Generative AI In The Fintech Industry

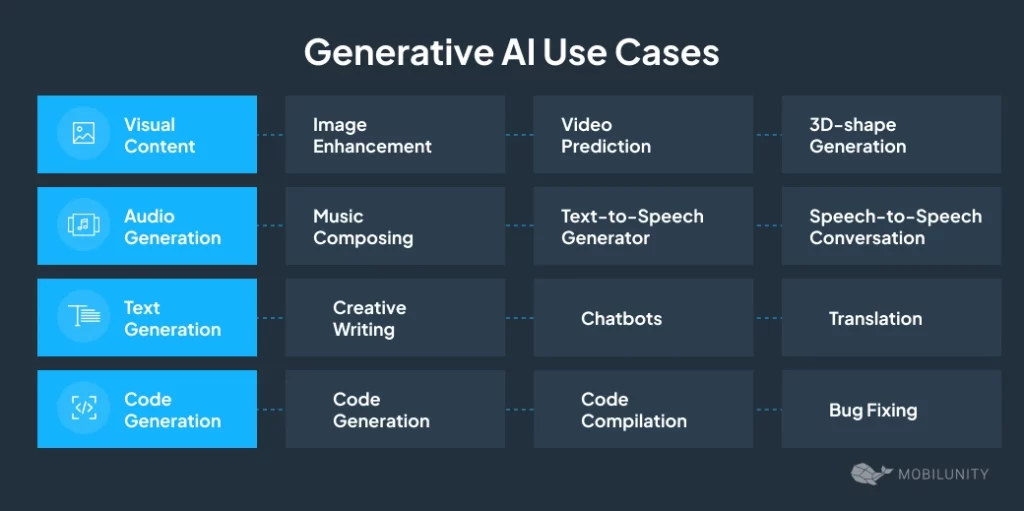

Use cases of generative AI go far beyond several domains. Developers implement these technologies in various industries and solutions.

Financial sector is one of the key players in integrating generative AI, there are a bunch of solutions that benefit from this technology, for example:

- Document and contract generation

- Reimbursement claim generation

- Customer service personalization

Let’s explore how Generative AI is transforming the fintech landscape, highlighting its most popular use cases, as well as the benefits and challenges it brings to the industry.

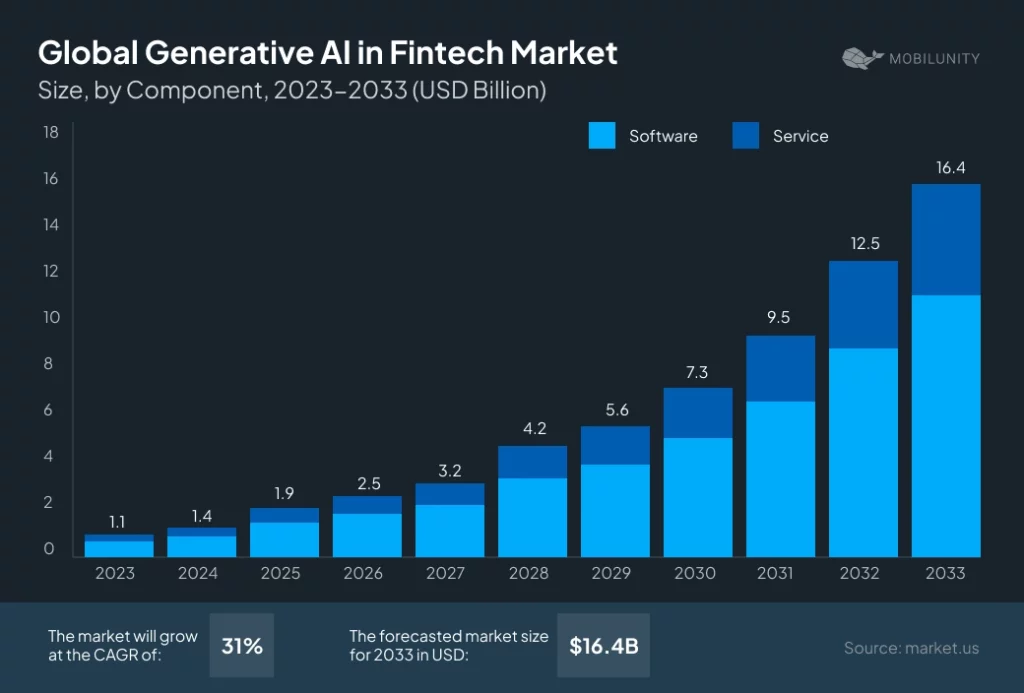

The Future Of Generative AI In FinTech: Market Overview And Trends

The global generative AI in fintech market is expected to grow significantly, reaching around USD 16.4 billion by 2032, up from USD 1.1 billion in 2023. This represents a strong compound annual growth rate (CAGR) of 31% during the 2024-2033 forecast period.

Top 3 trends of genAI in fintech

#1 Intelligent automation in finance

Intelligent automation is transforming financial services by making fintech operations faster, more efficient, and precise. It is promoting the standardization and streamlining of essential financial procedures, aiding firms in increasing their efficiency.

Automation goes beyond simply accelerating single tasks; it has the capability to optimize entire processes. Automated processing centers are capable of managing and confirming tasks with very little human involvement. Some advantages are:

- Increased speed of processing. Automation allows for simultaneous processing and distribution of workloads, decreasing delays and enabling round-the-clock operations across different time zones.

- Improved quality assurance. Maintaining consistent quality standards aids in detecting and minimizing repeated mistakes.

- Enhanced services. Quick and precise procedures boost confidence and contentment for customers and collaborators.

- Decreased physical footprint. Automation reduces the requirement for spacious offices and external contracting by combining operations.

#2 AI-powered advisory and asset management

AI and ML are transforming how personal finance and asset management are conducted. AI-driven financial advisors are quickly gaining traction, providing tailored suggestions for budgeting, investing, and handling debt according to a person’s unique financial behaviors.

- Financial planning. AI advisors can assist individuals in developing budgets tailored to their income and expenses, pinpointing ways to save money.

- Investing. These tools provide personalized investment recommendations based on financial objectives and risk tolerance, while constantly overseeing investments.

- Debt management. With the assistance of AI, users can create strategies to settle debts by monitoring expenses and motivating advancement.

AI-powered tools will make personalized financial advice more available, replacing the old-fashioned one-size-fits-all method. Asset management is set to become more AI-driven, enabling companies to automate portfolio management, optimize investments, and provide a broader selection of investment options.

# 3 More generative AI solutions

Generative AI is influencing different areas of fintech, such as fraud prevention, asset management, and credit scoring.

- Credit scoring and risk assessment. Using Generative AI to analyze transaction histories, spending patterns, and client data enables companies to make better judgments when evaluating creditworthiness or investment risks.

- Algorithmic trading. AI is changing trading by examining live market conditions and automatically executing trades according to predefined factors such as price and volume. This enables trading to be done more efficiently and accurately with minimal involvement from humans.

- Preventing fraud. Generative AI is crucial in detecting suspicious patterns in transaction data, aiding in the prevention of fraud. It is projected that by 2032, the global fraud detection market will exceed $252 billion, driven largely by AI.

- Compliance with regulations. Generative AI observes financial regulations instantly and automates tasks for compliance, thereby decreasing the chances of errors and breaches of regulations.

- Tailored financial services. Generative AI enables financial guidance by providing personalized, data-informed suggestions for investments and budgeting. It has the ability to generate personalized portfolios according to specific objectives and adjust them as needed.

- Chatbots powered by artificial intelligence. Sophisticated chatbots have the capability to provide advice based on the context of the conversation, recall past chats, and give personalized help when choosing investments and making financial choices.

The use of Generative AI in fintech will keep expanding, enhancing personalization, efficiency, and security in financial services for both businesses and individuals.

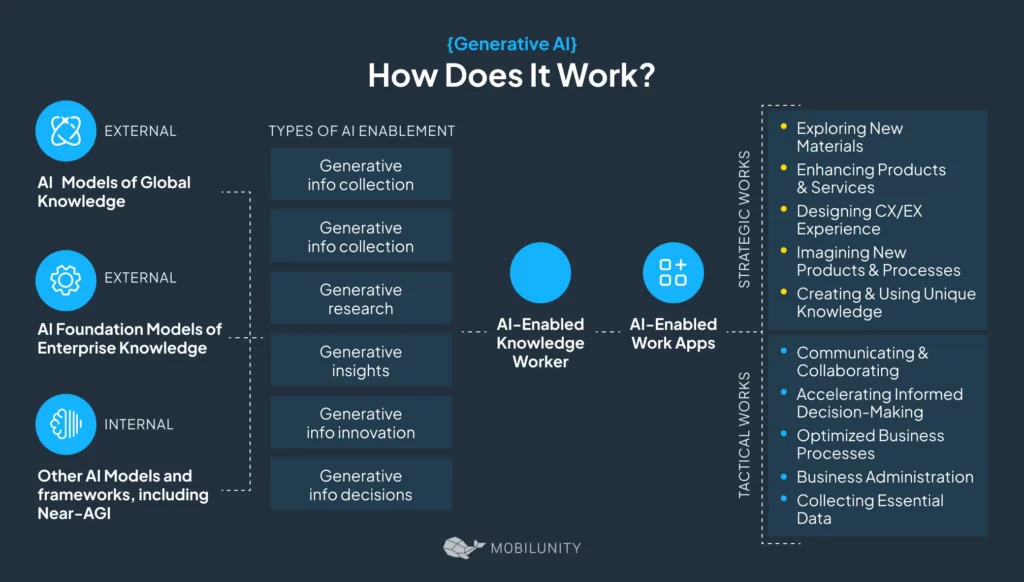

How Does Generative AI Work For Fintech?

Just like for any other sector, in fintech generative AI technologies have a groundbreaking capability to analyze vast amounts of data, detect patterns, styles, and structures, and generate innovative content based on the information it has acquired.

The main components of generative AI are advanced neural network algorithms and architectures, including generative adversarial networks (GANs), variational autoencoders (VAEs), and transformer models. These formations enable artificial intelligence to engage in a range of imaginative tasks, such as generating lifelike images and videos, composing texts that mimic human writing, and crafting music.

AI starts with a training period, where it is given access to huge volumes of data. For instance, the text generation model analyzes extensive written content and explores the subtleties of language, grammar, and style. Likewise, a model that generates images gains knowledge of patterns, colors, and compositions through analyzing extensive image datasets.

Key Benefits Of Generative AI For FinTech Industry

In order to fully maximize the benefits of generative AI, financial institutions utilize generative AI systems that can be implemented now.

- Efficient document processing. GenAI is also changing how documents are managed in banking. It can rapidly extract and examine data from financial papers, expediting procedures such as loan requests and compliance assessments. This leads to shorter processing times, decreases human errors, and allocates resources for more challenging tasks.

- Enhanced fraud detection. Advanced pattern recognition abilities of generative AI improve fraud prevention within fintech. Analyzing transaction data for unusual activity assists companies in enhancing their security measures. Furthermore, AI enhances risk assessment models, increasing the accuracy of credit evaluations and underwriting.

- Improved cybersecurity. In the realm of cybersecurity in fintech, generative AI functions as a vigilant protector. It rapidly identifies and reacts to possible dangers, constantly adapting to new attack methods in order to enhance security and safeguard financial systems and user information.

- Transformation of the customer experience. Generative AI could transform the way personal finances are managed by providing individualized advice and suggestions. By examining personal spending patterns and money objectives, personalized recommendations are provided to assist individuals in making well-informed choices. This customized method enhances the bond between fintech platforms and their clients.

- Cost savings related to operations. Generative AI has the potential to greatly cut operational expenses within the financial sector by streamlining tasks such as handling customer inquiries and managing backend operations. This enables businesses to:

- Effectively handle tasks that occur repeatedly

- Reduce the need for human involvement

- Strategically distribute resources

- Promote creativity and expansion

- Innovative product evolution. Generative AI is essential in the creation of innovative financial products. By studying market trends and customer habits, it spots gaps and chances for companies to develop new financial solutions that address changing customer demands to stay ahead of competitors.

- Insights and predictions for the market’s future. Generative AI is highly proficient at analyzing large financial datasets to provide precise market forecasts and strategic recommendations. This enables fintech businesses and investors to make decisions based on market data, resulting in improved results and increased returns.

Top Generative AI Use Cases In FinTech

The advancement of applications of generative AI is quickly progressing and could offer significant advantages to the financial industry. However, in order to maximize its potential, companies should concentrate on use cases for generative AI that genuinely provide value.

Below are five possible use cases for fintech firms to utilize generative AI in order to enhance their operations and boost their profits:

|

Use case |

Explanation |

Example |

|

Intelligent document processing |

– Enable underwriters to customize risk queries for unique perspectives and deep insights – Identify potential fraud patterns and preempt fraud attack |

Planck MasterCard PayPay Visa |

|

Data summarization |

– Workflow automation for loan processing and underwriting – Unified data management and document standardization |

Ocrolus Aio Logic |

|

Analyzing potential investments |

– Detect patterns and topics that could be difficult for humans to identify – Examine financial results presentations, official announcements, and online platforms to discover potential investment chances |

Morgan Stanley |

|

Financial advisors |

– Examine customer data in order to provide personalized advice on budgeting, investments, and financial planning |

Visa MasterCard |

|

Tailored marketing & customer experience |

– Identify trends and patterns in data – Leverage customers’ financial footprints to offer personalized product offerings |

Morgan Stanley |

#1 Intelligent document processing

Machine learning tools like AWS Textract and Comprehend can accelerate the document processing with the help of generative AI. This aids in swiftly extracting and examining data from items such as loan applications, mortgage papers, and compliance documents.

In the realm of fintech, this translates to a reduced amount of time dedicated to examining paperwork such as income statements and tax returns. Instead of manual input, AI extracts important information such as income verification and credit history, making the approval process faster and decreasing mistakes.

#2 Data summarization

Given the vast amount of data accessible nowadays, it is simple to feel inundated. Generative AI is able to rapidly sift through large amounts of data and provide a succinct summary of key points.

Fintech professionals can utilize AI to quickly summarize financial reports, market trends, and investment opportunities, thus saving time and enabling leaders to make more informed decisions. Over time, artificial intelligence tools can be trained to generate summaries tailored to the unique requirements of individual businesses.

#3 Analyzing potential investments

Integration of generative AI allows examining extensive quantities of disorganized or unstructured data, making it ideal for assessing investment possibilities. AI can be a valuable tool for private equity firms looking to evaluate companies with limited public information.

By gathering information from various sources, AI detects patterns and topics that could be difficult for humans to identify. It is also able to track public opinion through examining financial results presentations, official announcements, and online platforms to discover potential chances, such as a business close to receiving regulatory clearance for a new product.

# 4 Financial advisors powered by artificial intelligence

AI has the capability to fuel intelligent chatbots and automated advisors that deliver tailored financial guidance. In contrast to conventional chatbots, these AI tools have the ability to examine customer data in order to provide personalized advice on budgeting, investments, and financial operations.\

Investors may also utilize AI robo-advisors for cheaper investment management. These tools have the ability to evaluate risk, monitor market conditions, and recommend tactics such as diversifying portfolios or rebalancing.

AI-driven call centers can assist customer service representatives in resolving issues quicker and providing more self-service choices. Fintech firms can provide quicker, more effective customer service by integrating AI with platforms such as AWS Connect and Lex.

AI chatbots can assist with basic customer inquiries, allowing human agents to concentrate on tackling more intricate problems. These tools help expedite customer service and reduce costs by charging for real interactions only.

# 5 Tailored marketing & customer experience

Generative AI algorithms have the potential to enhance marketing campaigns by producing tailored content for individual customers. Using services such as AWS Pinpoint and SES, companies have the ability to send personalized emails, SMS messages, and push notifications to customers based on their preferences and actions automatically.

AI assists businesses in responding instantly to market fluctuations or changes in customer attitudes, guaranteeing that the appropriate message is delivered promptly. This degree of customization helps maintain customer interest and enhances the efficiency of marketing efforts.

In fintech, the use of generative AI is not only to automate tasks; it is also aimed at enhancing customer experiences in fintech and boosting growth by making faster and smarter decisions.

Challenges And Risks Of Generative AI In The Fintech

With an increasing number of companies applying Generative AI tools, it is essential to comprehend the associated security threats and their possible outcomes. Below is an analysis of several commonly recognized security issues and limitations.

#1 Protection of data privacy and security

- Possibility of data breaches. Generative AI models may unintentionally reveal confidential or private data due to being trained on extensive datasets. Dealing with personal data can lead to breaching privacy regulations such as GDPR in the EU and CCPA in California.

- Utilizing private information. Not anonymizing data when training AI results in privacy violations or unauthorized use.

- Challenges in identifying data sources. It is frequently difficult to determine the origins of data utilized in AI training, leading to difficulties in holding individuals accountable.

Ways to reduce negative impacts:

- Differential privacy. Obscures the resulting data to prevent identification of a specific individual.

- Artificial data. By training models on synthetic data, the chance of real-world data being compromised is minimized.

- Data obfuscation. Alter personal data to prepare AI models for training.

- Frequent examinations. Continuously monitor AI results for possible breaches or infringements of privacy.

#2 Misinformation

- Possibility of inaccurate or biased information. The power of generative AI allows producing content that appears believable but may contain inaccuracies or biases. This could pose a risk in business environments, resulting in inaccuracies or poor choices.

- Illusions. Occasionally, AI models produce data that is disconnected from real-life conditions, adding to the challenge of trust and dependability.

Ways to reduce negative impacts:

- AI vs AI. Utilize AI-driven technology to identify and highlight deceptive or inaccurate information.

- Content validation. Incorporate digital watermarks or signatures in order to verify the authenticity of content.

- Regularly updating. Ensure AI models are kept up to date with precise and up-to-date data.

- Verification by a person. Verify AI-generated content with credible sources at all times.

#3 Issues regarding copyright

- Possibility of copyright violation. AI may produce content that infringes on intellectual property rights if it is trained using copyrighted information.

- Ambiguous ownership. In the United States, there is a lack of explicit legislation regarding ownership of AI-generated content, resulting in each case being dealt with individually.

Ways to reduce negative impacts:

- Full disclosure. Always be transparent about the use of AI in creating content, in line with regulations such as the EU AI Act.

- Continuous supervision. Monitor AI-generated content regularly to prevent any copyright infringements.

Businesses can use generative AI with confidence by recognizing and addressing risks while implementing appropriate safety measures to reduce security concerns.

To Wrap Up

Generative AI is significantly transforming the fintech industry by optimizing processes and enhancing decision-making capabilities. Its applications, which include fraud detection and customer support, are continually advancing.

As fintech companies embrace this technology, it’s essential to bring on skilled and qualified experts who can navigate these advancements effectively.

At Mobilunity, we provide access to experienced engineers specialized in generative AI. Fintech developers we helped hire have successfully delivered projects for clients across over 40 countries, ensuring high-quality results in any financial segment.

If you’re interested in exploring how dedicated developers can elevate your fintech initiatives, feel free to schedule a call with us. We’d love to discuss how we can support your vision!