Hottest Trends in Insurance Software Development

We all know how important insurance is in the life of each of us. It makes our lives easier, reduces the amount of stress, and helps to solve a bunch of different problems in the easiest way. That is why insurance is firmly entered into every sphere of human life and has taken its place of honor in the business world. Like any other business, even if it is known to man since ancient times, insurance should change, evolve and go forward with the times in order not to become part of the past. And this is the only way to survive because the usual classic insurance with all its bureaucratic procedures and difficulties gradually fades into the background and gives way to digital technologies, fintech development, and insurtech companies. That is why all over the world thousands of interested viewers gather at events that are entirely devoted to the development and trends of the modern insurance industry, top insurtech startups, and insurance software development such as the Finovate Europe, the Global InsurTech Summit, The Future of Fintech and many others.

In this article, we will discuss what is insurtech, what are the hottest trends in Insurance Software Development, and find out where the insurance business is going. Insurance software development is experiencing a surge in demand for experts in the hottest trends, such as Amazon cloud developer and Salesforce developer for hire, as insurers seek to stay ahead of the curve and remain competitive in a rapidly evolving market.

We will also pay attention to various types of software, that are currently being widely used in this field, for example, insurance agency management software. The thing is that insurance agencies are quite complicated to manage and therefore often require specialized software like that. It can help them with process optimization and significantly reduce the time of any transactions. These days more and more companies are considering using it and start implementing these programs into their business strategy. As we delve into the hottest trends in insurance software development, the demand for skilled health insurance software developer stands out, as they are at the forefront of creating innovative solutions that cater to the evolving needs and challenges of the healthcare insurance sector.

Why is multi-channel communication extremely important for insurance? Why does it attract more and more investments every year? Why such technologies as artificial intelligence, chatbots, the Internet of things, blockchain, and especially big data are inextricably linked with insurtech trends and spheres? According to EY every part of the business should be improved. Because 80% of customers are willing to use digital and remote channels for communications and different interactions. That’s why software development is so popular. Almost 40% of customers who claimed to be the advocates of a certain brand can switch providers or cancel policies. Almost 45% of customers have had no interactions with their insurers for more than 18 months. According to the AppsRunTheWorld, 10 top insurtech companies divided among themselves as much as 42% of the global insurance application market and got more than $10 billion in insurance license, maintenance, and subscription revenues. So, let’s talk some more about why you should join the revolution.

Digitalise or Die: Trends for Software Development Insurance

Before we begin to talk about the trends, let’s find out what is insurtech. As Insurtech Magazine tells us, the insurtech definition was created using the word fintech as an example and this is a huge revolution in technology associated with the use of the latest technologies in the insurance industry. One of the hottest trends in insurance software development is the managing offshore teams, particularly for offshore Salesforce development, which requires effective strategies for managing remote teams and ensuring seamless collaboration across time zones and geographies.

Today’s best insurance software companies know exactly what their SW developers need to work on to be competitive in the market and provide services to their users at the highest level.

One of the things they are trying to focus on the most is insurance claims management software. Everyday insurance companies receive thousands of claims from their clients. Considering that these claims are pretty sensitive to details, all managers should be extra careful to not lose a piece of information. Obviously, people are not robots, so it might sometimes be hard for them to keep everything perfectly organized. This is when software like this comes in handy and ‘saves the day’. By using specialized software insurance companies can be sure that they will provide the best services to their clients and not a single drop of information will be missed.

Another great tool, in this case, would be the implementation of the insurance billing software. It can significantly speed up the process of dealing with clients and optimize the payment routine. More than that, such tools get you, as a company owner, a deeper insight into the financial situation with clients and eliminate any possible mistakes. The fourth industrial revolution dictates a clear list of trend technologies that should be paid attention now and in the near future to almost all businesses in the world. Deviation from these trends can be considered as a company suicide by losing competitiveness, customer base, and the latest tech.

Key technologies whose development affects insurance software development:

- Chatbots

- Artificial Intelligence and Machine Learning

- Big Data & Cloud Tech

- Blockchain

- Internet of Things

- Cyber Security

Let’s start from the very beginning and see why each of these technologies plays a major role and how they influence the development of the insurance business. Of course, they can all help your business improve its interaction with your potential customer, make it more secure, efficient, smart, and productive.

- Chatbots

For example, the use of chatbots has long proved its effectiveness. Although communication with a live consultant is perceived much closer and more pleasant, the absolute majority of questions from potential consumers of services usually do not go beyond the top 20 from the FAQ section. But since usually no one enters this section and does not read all the necessary information, chatbots encourage people to ask all their questions and answer them more efficiently and quickly.

- Artificial Intelligence

But chatbots have no longer surprised anyone, especially when artificial intelligence comes in which is trained in the tricks of communication, information gathering, and using it for the benefit of the company.

AI becomes of special relevance when it comes down to the creation of an insurance verification software. As you know, before getting paid, a person must prove that his case falls under certain rules of getting the insurance. Very often this verification process takes a lot of time and is quite monotonous. This is when AI could step in and ‘save the day’. A combination of artificial intelligence and insurance verification software proved to be a great idea on every level.

Along with the verification process, an insurance company always pays attention to the estimation that is why there is always a need for insurance estimating software. This is the second step for a person on his way to receive an insurance check. They are the main engine of change and can help the insurtech companies to get ahead of all competitors or stay far behind in the absence of this technology. In addition to gathering information, artificial intelligence can greatly simplify the filing system, prevent fraud and money laundering. This will make the life of companies and customers much easier.

- Big Data & Clouds

Other important technologies are Big Data and Cloud Storages. You can hear about them in any insurtech accelerator and in any insurtech startups. The first will help the company use huge amounts of data to attract new customers and simplify the process of finding uninsured risks. For example, data from the user’s car on repair, parts replacement, damage, medical records and data from wearable devices, travel and work data, and many others. And yes, this is the very Internet of Things that will also closely bond our daily lives and the services of an insurance company. The second technology will help companies get rid of iron in the office to store all these data, which is worth its weight in gold. Cloud is convenient, fast, easy, and secure.

- Blockchain

And if we are talking about security and reducing human errors and poorly drafted contracts, then the blockchain comes into play. This is another technology that is already moving a lot of business areas where contracts and encrypted data exist. Since companies are forced to enter into many contracts with other market players, it is necessary to be sure that all cooperation and coordination will take place without errors and with a minimum of the human factor. This is when you might want to start thinking about getting some strategic insurance software to ensure that your planning is coordinated and you do not miss out on something. With the help of a proper specialist and a piece of software like that you will be able to handle your blockchain projects with ease. In addition, it will be easier for insurers to create an ecosystem for their users around themselves. The best insurtech companies are trying to use all the available potential of these technologies and improve their interaction with the client and the quality of their services.

- Internet of Things

The more devices will be used without an additional human factor, the faster the processes will take place and the fewer errors there will be. In this way, the sphere of insurtech can prove itself by automating the insurance of many separate processes of human life. By becoming more customer-oriented the insurance industry will be able to slowly move away from covering large layers of human life, such as traveling abroad, cars, or health care to more specific small processes. This again will help collect more valuable information about the consumer, improve the service for each individual based on their needs and cover only those insurance claims that have a really high chance of occurrence.

- Cybersecurity

The development of cybersecurity is gaining momentum along with the speed of evolution of digital technology. If earlier some personal information was under threat of hacking, now, when an infinite number of devices are interconnected into huge ecosystems, the security of entire countries is threatened. Voting, banking, transfer of any data, device management and shutdown, sabotage of services, and much more. All this is becoming more and more commonplace in the world of cybercrime, and therefore cybersecurity cannot stand still.

The Role of Insurance Software Engineer

To build the insurance software needed, an insurance company hires an insurance engineer with relevant knowledge and experience. Usually, an insurance software developer doesn’t participate on a project basis but helps the insurance organization with developing and managing internal software, as well as building insurance-related solutions for their clients if needed.

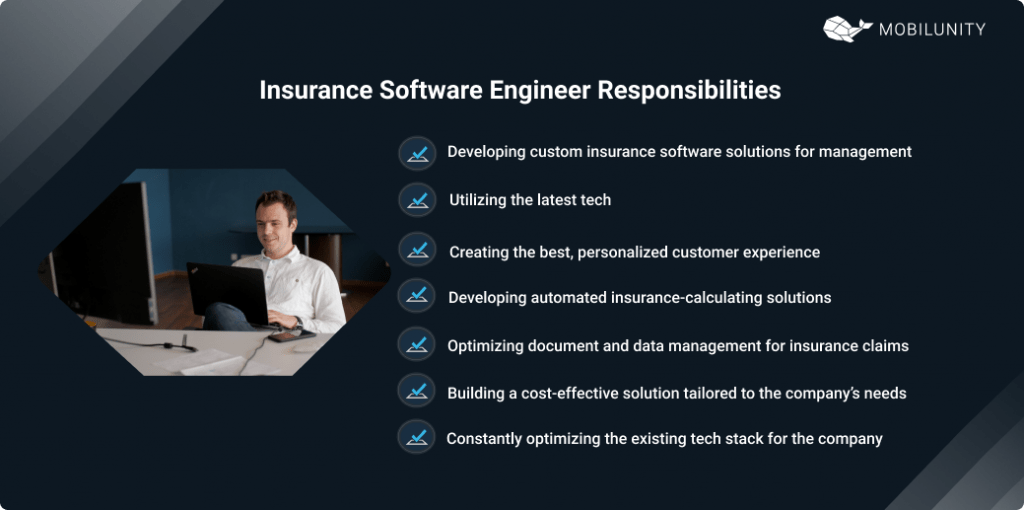

The responsibilities of an insurance coder may include but are not limited to:

- Developing custom insurance software solutions for management and optimization of insurance operations;

- Utilizing the latest tech, including AI, the Internet of Things, and blockchain, to build state-of-the-art solutions;

- Creating the best, personalized customer experience when using insurance software;

- Developing automated insurance-calculating solutions with the help of Big Data, AI, and IoT;

- Optimizing document and data management for insurance claims;

- Building and maintaining a cost-effective solution tailored to the company’s needs;

- Constantly optimizing the existing tech stack for the company to stay competitive in the market.

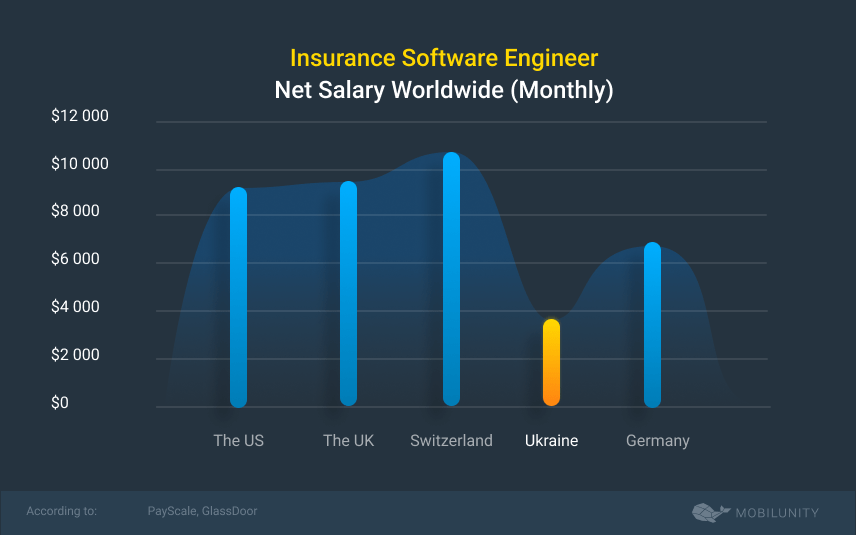

Let’s take a look at the insurance coder salary rates in different countries, given the similar skillset and expertise of an expert:

- The US – $9,195/month

- The UK – $9,217/month

- Switzerland – $10,950/month

- Germany – $6,425/month

- Ukraine – $3,100/month*

*Ukrainian salaries are provided based on Mobilunity’s Recruitment Team research on the local job markets. All salaries are net and do not include the service fee (in the case of hiring on a dedicated team model). The salaries are provided for comparison purposes and could not be entirely accurate. Contact us to know the exact cost of hiring a developer corresponding to the required parameters.

As you can see, salary rates of Ukrainian insurance software programmers are lower than European ones and those of the US, while Ukrainian developers are known worldwide for their top-level programming skills and ability to build high-performing complex solutions. That’s why many insurance companies tend to hire Ukrainian coders for their software projects.

Insurance Software Explained in Brief

Let’s discuss the most popular insurance-related software that insurance companies need for successful operation on the market:

- Insurance quoting software

Insurance quoting implies calculating the amount of money that the insurance company considers the cost of providing insurance for something. Insurance quoting software, such as life insurance quoting software, aims to automate and improve these processes, making them paperless, flexible, and compliant. Such solutions are not limited to life insurance software but also may cover health and auto quotes.

- Insurance accounting software

Such insurance software products as insurance accounting solutions allow for literally paperless work, with all the documents stored digitally and be easy to access. High-quality insurance accounting software can manage policies of multiple layers and currencies, be integrated with other software, and easy policy workflow and claims processing management.

- Insurance product development

Based on external drivers, such as customer demand and expectations, as well as industry drivers, including digitalization pressure and cost-effectiveness, companies may need to develop a new insurance product that will meet the market demand and bring value to both consumers and insurance software vendors.

- Insurance broker software

Insurance software development can help to build a broker solution for the insurance company to make the work with brokers easier and more efficient. With such software, brokers may, for example, manage their customers’ profiles, contact carriers, and sell policies.

- Insurance CRM software

Insurance CRM solutions are tools for effective customer relationship management, which allow insurance organizations to deliver a great customer experience at every step of the customer journey, nurturing leads into repeat businesses.

- Insurance policy management software

A software engineer insurance can help build an insurance policy management solution to help the company manage such core policy processes as a rating, quoting, binding, renewals, and more, keeping all the created insurance policies in one place.

Still doubting where to hire insurance software engineer? Rely on trusted vendor with solid experice in hiring devs of any level. Contact Mobilunity

What Does an IT Consultant Insurance Do?

Often, when business is doing well, the question of insurance goes into the background. Company owners prefer to think that the risks are minimal and you can do without unnecessary waste. A reasonable decision would be to worry about the possible risks in advance and hire a qualified IT consultant insurance to get advice.

There are several types of IT consultant insurance: property insurance and general liability insurance. If customers could encounter the first type of insurance, then general liability insurance may not be known to them. This type allows you to cover embezzlement in case you accidentally damaged the client’s property.

Modern Tools that Insurance Software Development Companies Are Using Now

Using the entire list of modern technologies described above by software development insurance companies achieve significant success in improving their interaction with the client.

- Reducing the human factor in workflows – automating advertising, purchasing and regulating insurance services becomes as personalized as possible.

- Using the collection and accumulation of information for deep analysis of customer needs and selection of the optimal package of services. Especially relevant here would be the usage of a medical insurance verification software as this particular field is often associated with lots of documents that need to be kept in order and analyzed.

- The use of advanced CRM systems to improve the company’s work and monitor the effectiveness of various applied schemes and approaches for solving business problems.

- Simplified management and document flow. Reducing the amount of “paperwork” and bureaucratic processes that can inhibit the work of the company.

For example, they significantly reduce the insurance company’s expenses on customer support, since the burden on support workers practically disappears due to convenient bots and AI. In addition, they get the opportunity to interact with the information they have just received. For example, real-time tracking or information search, Industrial Key Risk Indicators. Simple and convenient CRM software for insurance companies is created by using specific templates or from scratch. Universal digitalization of processes makes it necessary to develop insurance companies software in such a way that it is possible to interact with the client remotely. Make it possible to submit applications, process payments, and billing as user-friendly as possible. Improving the protective mechanisms not only for storing information but also for concluding various contracts and ensuring the fulfillment of all conditions. Insurance services become very personalized and this requires a greater study of the lives and personal data of users, which means that it should be secured properly.

In addition to all the above, insurance software companies use different approaches to improving business processes. One of the ways is using insurance quoting software. It is a great tool when the insurance company needs to gather information about a certain case and wants to quote people for that matter. This way the final document will look more trustworthy and respectable. Another great example is the analysis of the insurance market and building a software development plan. Workflow automation and document management simplification. Ignoring these factors will affect even top insurtech startups in the future and they will not withstand the load. What else? Of course, the creation of the application itself, checking its quality, and continuous maintenance. This is not the end of the work, as, like many others, software for insurance companies needs constant editing and development.

What You Should Pay Attention to When Developing an Insurance Product

Insurance product development software should always be on the edge of new technologies if the company wants to compete in the market. You need to ensure that the expertise of your specialists is enough to always keep the pace of the company’s development at the proper level. It does not matter which direction of insurance you choose: life and health, car insurance, insurance for software companies.

For example, insurance claims processing software executes claims in pretty much the same way, regardless of what niche you are trying to use it in. You just need to make sure that your software development specialists are the best you can find out there. In particular cases, it would also be a great idea to hire a software development consultant so that your work on your project will get the best possible outcome.

The obsolete approach is fraught with the loss of customers. Focus your efforts on your core tasks – on working with the client and management. You do not have to understand all the technologies used by the company, be able to explain what the blockchain is and why it is important to adapt the interface for smartphones. Leave it to insurance software development professionals.

User-based insurance (UBI) should be your standard, as an individual approach to each individual user will allow you to adjust the costs, the number of services provided and tracking potential risks. For this occasion, you might want to use a thing called insurance adjuster software, which will help you keep all your financial matters adjusted and counted. Currently, it is a very popular thing among insurance companies and their representatives, as this niche often deals with big amounts of money. Also, software development company insurance should be just as pleased with your services as you are with their services. Do not forget about prioritizing your customers and do not lose sight of what people most often pay attention to.

To make sure that it is not only you, who cares about customer-centricity, but you should also give a thought to implementing insurance policy software into your company. This will be a reminder to all your employees about your company’s priorities.

If your company created clothes, you would wear it to show the style and quality of your product.

Top Insurtech Startups and How Did They Manage It

Over the past few years, the insurance industry has grown dramatically. Lots of different types of software were created for this occasion like insurance administration software. Using this type of software it became so much easier for insurance agents to manage their tasks and optimize their time. Lately, amazing and interesting insurance software companies have begun to appear among typical insurance companies that have begun to bite off large chunks of the market and attract the attention of investors and users around the world. Among others, it is worth mentioning such projects as Amodo©, Bold Penguin©, and Cyberwrite©. All of these insurtech companies are in the top 5 best startups in the world and this is no accident.

Amodo© uses powerful analytics about product usage and user behavior to create new products and digital direct channels. Thus new services appear and user involvement is automated. The company has become popular due to the possibility of multisolution on one platform and the universality of approaches to any client problems. Bold Penguin© decided to take on the simplification of the interaction of different subjects of insurance and speed up the buying process. Now the client, the agent, and the carrier are connected with an effective thread of communication, and the engine of recommendations is constantly improving and using the data obtained to better predict the risks that are worth insuring. Cyberwrite’s© natural environment is cyberspace, where they work to improve customer interaction, search for risk models, and build a safe insurance ecosystem. Their main product is cyber insurance risk management tools that will help companies better understand the risks and make the most correct and understandable decisions as quickly as possible.

All these startups are somehow connected with the use of the list of technologies that we talked about above. The essence of them is that you need to select a specific list of problems or a single problem and try to solve it with all the forces and tools. The better you get to find the pain of the consumer and relieve him of it, the more successful your business will be. For an investor, the most important thing is to show this problem, prove that it exists, show your team and their expertise, and then show the way and the set of technologies and tools that you are going to operate with.

Mobilunity and Insurtech in Ukraine

If you decide to develop an insurtech branch in your company and at the same time do not disperse into many third-party processes, Ukraine will be an ideal choice in many ways. There are thousands of successful startups, hundreds of R&D centers, each SW developer is fluent in English and a powerful set of development skills. Moreover, there are various types of software developers that will be able to bring to life any project you might have in your head. For example, if you are aiming to use insurance accounting software, Ukrainian specialists will be more than just willing and, which is even more important, qualified, to create one for you and make it running.

While the price of the work of these experts is much lower than in the States or other western parts of the world. Ukraine is among the top list of countries in terms of speed and quality of development, growth in the number of technical specialists issued by universities, the attractiveness of foreign investment and the emergence of new centers and branches of large foreign IT companies.

Mobilunity will help you find, assemble and integrate a team of experienced specialists who will be focused on solving your specific problems and developing your company in the way you have chosen. Insurtech selected developers will have the most appropriate set of tools for working in this field and will be able to cover all your company’s needs within the deadlines, budget, and tasks assigned to them.

Find experts in insurance software development to work on your project with Mobilunity’s help!

All salaries and prices mentioned within the article are approximate NET numbers based on the research done by our in-house Recruitment Team. Please use these numbers as a guide for comparison purposes only and feel free to use the contact form to inquire on the specific cost of the talent according to your vacancy requirements and chosen model of engagement.